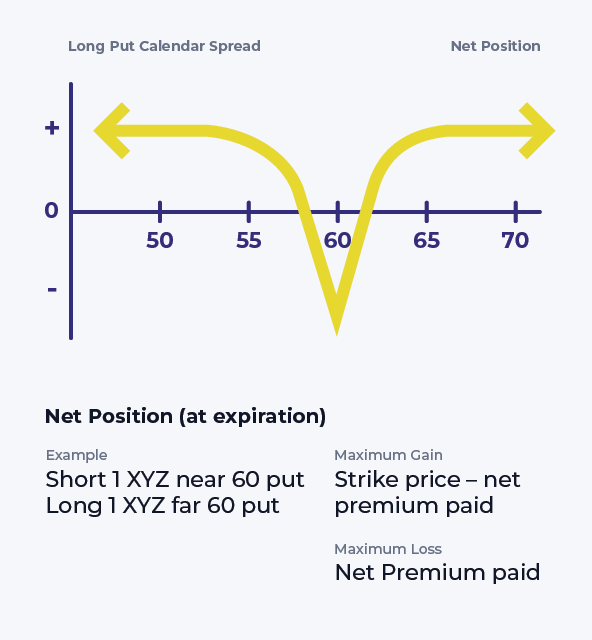

Put Calendar Spread - There are two types of calendar spreads: Additionally, two variations of each type are possible using call or put options. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The forecast, therefore, can either be “neutral,” “modestly. Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term.

Bearish Put Calendar Spread Option Strategy Guide

There are two types of calendar spreads: A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. The.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: Calendar spreads allow traders to construct a trade that minimizes the effects of time. The forecast, therefore, can either be “neutral,” “modestly. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the.

What Is A Calendar Spread Option Strategy Mab Millicent

The forecast, therefore, can either be “neutral,” “modestly. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A.

Long Calendar Spread with Puts Strategy With Example

The forecast, therefore, can either be “neutral,” “modestly. Additionally, two variations of each type are possible using call or put options. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can.

Short Put Calendar Spread Printable Calendars AT A GLANCE

A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Additionally, two variations of each type are possible.

Long Put Calendar Spread (Put Horizontal) Options Strategy

Additionally, two variations of each type are possible using call or put options. There are two types of calendar spreads: Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put.

Calendar Put Spread Options Edge

A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. Put calendar spreads, traditionally employed for a neutral to.

Bearish Put Calendar Spread Option Strategy Guide

Calendar spreads allow traders to construct a trade that minimizes the effects of time. Additionally, two variations of each type are possible using call or put options. There are two types of calendar spreads: Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: The forecast, therefore, can either be “neutral,” “modestly.

Put Calendar Spread Option Alpha

The forecast, therefore, can either be “neutral,” “modestly. Additionally, two variations of each type are possible using call or put options. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long calendar put spread is seasoned option strategy where you sell and buy.

A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. The forecast, therefore, can either be “neutral,” “modestly. Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Calendar spreads allow traders to construct a trade that minimizes the effects of time. There are two types of calendar spreads: A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Additionally, two variations of each type are possible using call or put options.

A Long Calendar Put Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Puts With The Purchased Put Expiring One Month Later.

There are two types of calendar spreads: A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Additionally, two variations of each type are possible using call or put options. Calendar spreads allow traders to construct a trade that minimizes the effects of time.

A Long Calendar Spread With Puts Realizes Its Maximum Profit If The Stock Price Equals The Strike Price On The Expiration Date Of The Short Put.

Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: The forecast, therefore, can either be “neutral,” “modestly.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/cdn.prod.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)